By Don Briscoe, a personal finance educator with over 12 years of experience guiding everyday people through smarter banking, credit, and money decisions.

TL;DR — Improve Your Credit Score Before Applying for a Loan

- Payment history is king: 35% of your FICO score—set up autopay and never miss a payment in the 3-6 months before applying

- Utilization quick win: Pay down credit cards below 30% of limits (under 10% for max boost)—pay before statement dates to report lower balances

- Dispute errors immediately: Pull free reports from AnnualCreditReport.com and dispute inaccuracies—removals can boost scores 50-100 points

- Strategic timing matters: Hard inquiries drop scores 5-10 points each—stop all credit applications 3-6 months before your loan

- Timeline reality: 30-60 days for utilization fixes, 3-6 months for noticeable improvement, 6-12 months for major score recovery

Updated January 21, 2026

Your credit score can make or break your chances of getting approved for major financial moves. Whether you're applying for a car loan, mortgage, or personal loan, lenders look at that number first. A stronger score doesn't just boost your approval odds—it can save you thousands in interest over time.

The good news? You can start improving your score before you apply. Unlike income or employment history, your credit score is something you have direct control over—and the strategies that move the needle don't require massive lifestyle changes.

This guide shows you exactly how to optimize your credit score in the weeks and months before applying for a loan, using proven tactics that address the factors lenders care about most.

For a complete overview of credit improvement strategies and how they fit into broader debt and credit repair, visit our debt relief and credit repair hub. Then return here for pre-loan credit optimization tactics.

Understanding What Lenders Actually Look At

Before we dive into improvement strategies, you need to understand what makes up your credit score and what lenders prioritize when evaluating loan applications.

The FICO Score Breakdown

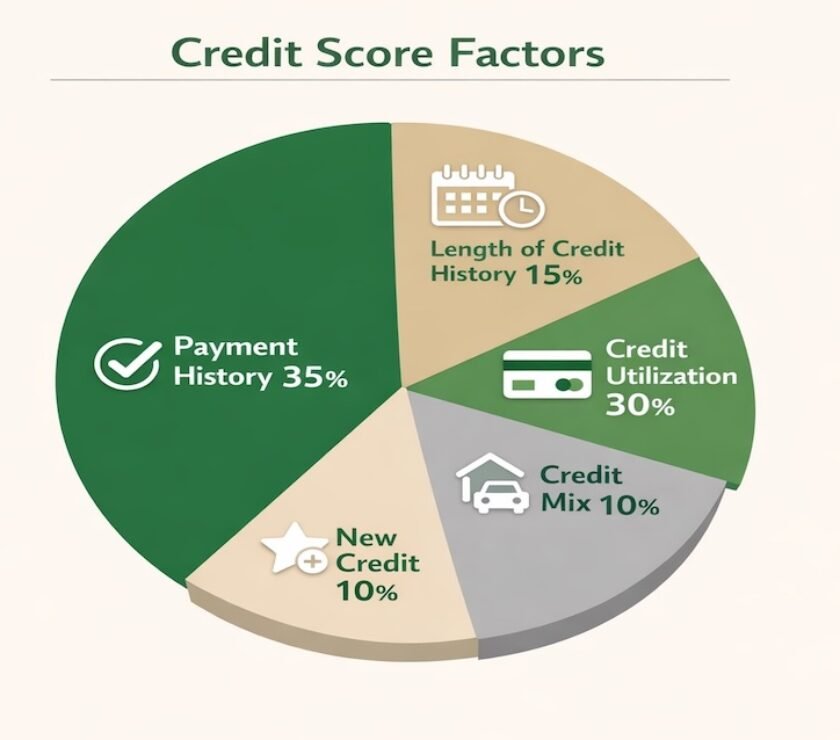

Your FICO score (the one most lenders use) is calculated from five factors:

- Payment History (35%): Whether you pay bills on time is the single biggest factor

- Credit Utilization (30%): How much of your available credit you're using

- Credit Age (15%): How long your accounts have been open

- Credit Mix (10%): Variety of account types (credit cards, installment loans, mortgages)

- New Credit Inquiries (10%): Recent credit applications and hard pulls

What this means for pre-loan prep: You can't quickly change your credit age or mix, but you can dramatically improve payment history and utilization in 30-90 days—and those two factors represent 65% of your score.

Why Improving Your Score Matters

The difference between a 620 credit score and a 740 credit score on a $300,000 mortgage isn't just approval—it's tens of thousands of dollars in interest.

Real example (30-year mortgage at current rates):

- 620 score: 7.5% APR = $2,098/month payment, $455,280 total interest paid

- 740 score: 6.0% APR = $1,799/month payment, $347,640 total interest paid

- Difference: $299/month savings, $107,640 saved over life of loan

Even a 40-50 point score increase can move you into a better rate tier. That's why pre-loan credit optimization is worth the effort.

Step 1: Pull Your Credit Reports and Identify Quick Wins

Before you can improve your score, you need to know exactly what's on your credit report—and what's dragging it down.

How to Access Your Reports for Free

Go to AnnualCreditReport.com (the only government-authorized site for free reports) and pull reports from all three bureaus: Experian, Equifax, and TransUnion.

Why all three? Lenders can pull from any bureau, and errors on one report won't appear on others. You need to know what each bureau is reporting.

What to Look For (Red Flags That Hurt Your Score)

Errors and inaccuracies (dispute immediately):

- Accounts that don't belong to you (identity theft or mixed files)

- Payments marked late when you paid on time

- Incorrect balances or credit limits

- Old collections that should have dropped off (7 years from first delinquency)

- Duplicate accounts reported multiple times

- Closed accounts still showing as open

Legitimate negatives (address strategically):

- High credit utilization on cards

- Recent late payments (last 6-24 months hurt most)

- Collections or charge-offs

- Recent hard inquiries from credit applications

How to Dispute Credit Report Errors

Step 1: Go to the credit bureau's dispute page online (Experian, Equifax, TransUnion each have their own)

Step 2: Select the specific item you're disputing and explain why it's incorrect

Step 3: Upload supporting documentation (bank statements, payment confirmations, correspondence)

Step 4: Wait 30 days for investigation results (bureaus must respond within 30 days by law)

Result: If the bureau can't verify the item, it must be removed. Your score typically updates within 30-60 days after removal.

For comprehensive credit repair strategies beyond disputing errors, including how to rebuild after negative marks, see our credit repair guide for Millennials.

Step 2: Optimize Credit Utilization (The Fastest Score Boost)

Credit utilization is your secret weapon for quick score improvements. It's the ratio of your credit card balances to your credit limits, and it accounts for 30% of your FICO score.

The Utilization Math That Matters

How it's calculated: Total balances ÷ Total credit limits = Utilization ratio

Example:

- Card 1: $2,000 balance / $5,000 limit

- Card 2: $1,500 balance / $10,000 limit

- Card 3: $500 balance / $5,000 limit

- Total: $4,000 balance / $20,000 limits = 20% utilization

Utilization Targets for Maximum Score Impact

- Under 30%: Good—you're not hurting your score

- Under 10%: Excellent—prime score territory

- Under 1%: Optimal—though not necessary for most people

- 0%: Not ideal—lenders want to see you using credit responsibly

The sweet spot for loan applications: 5-10% utilization shows you're using credit but managing it well.

The Statement Date Trick (Game-Changer)

Most people don't realize this: the balance reported to credit bureaus is usually your statement balance, not your current balance.

The hack: Pay down your credit cards before the statement closing date, not the payment due date.

Example:

- Statement closes: 15th of month

- Payment due: 10th of following month

- Current balance on 14th: $3,000

- You pay $2,500 on 14th → Statement balance: $500

- Credit bureaus see: $500 balance (much better utilization)

This simple timing shift can improve your utilization immediately without actually paying off more debt—just paying strategically.

Quick Utilization Improvement Strategies

If you have cash available:

- Pay down high-utilization cards first (above 50% utilization)

- Target cards to get them all under 30%, then under 10%

- Leave small balances (1-5% utilization) to show active use

If you don't have cash to pay down balances:

- Request credit limit increases on existing cards (increases available credit, lowers utilization ratio)

- Open a new card and transfer balance (only if you have 6+ months before loan application)

- Ask to become an authorized user on someone's low-utilization card

Step 3: Perfect Your Payment History

Payment history is 35% of your credit score—the single biggest factor. The good news: even if you've had late payments in the past, recent on-time payments carry more weight.

The Payment History Timeline

How late payments impact your score:

- 0-30 days late: Usually not reported to bureaus (but interest accrues)

- 30 days late: Reported to bureaus, major score drop (50-100+ points)

- 60 days late: Worse impact

- 90+ days late: Severe damage, often leads to collections

How long late payments hurt:

- First 2 years: Maximum impact

- Years 3-5: Declining impact

- Years 6-7: Minimal impact

- After 7 years: Drops off report entirely

Building Perfect Payment History Before Your Loan

3-6 months before applying:

- Set up autopay on everything: Credit cards (at least minimums), loans, utilities, subscriptions

- Use calendar reminders: Set reminders 3 days before due dates to verify autopay executed

- Pay early when possible: Lenders can see "days past due = 0" which looks great

- Don't close old accounts: Keep them open with small autopay charges to show continued on-time payments

If you've recently missed payments:

- Call creditors immediately and ask for goodwill adjustment (if first-time or rare occurrence)

- Get current on all accounts before applying for new loan

- Build 6-12 months of perfect payment history to offset recent late payments

Real Example: Payment History Recovery

Emma's situation: Credit score dropped from 720 to 580 after missing two credit card payments during a job transition.

Her recovery plan:

- Caught up on all accounts immediately

- Set up autopay on every bill

- Made 6 months of perfect on-time payments

- Reduced credit utilization from 85% to 15%

Result: Score rebounded to 710 in 6 months, qualified for auto loan at favorable rate

Key takeaway: Recent positive behavior outweighs older mistakes—consistency over time rebuilds trust

Step 4: Strategic Management of New Credit Inquiries

Every time you apply for credit, the lender performs a "hard inquiry" that can drop your score 5-10 points. Multiple inquiries in a short period signal risk to lenders.

Hard Inquiries vs. Soft Inquiries

Hard inquiries (hurt your score):

- Credit card applications

- Loan applications (auto, personal, mortgage)

- Apartment rental applications (sometimes)

- Stay on report for 2 years, impact score for 1 year

Soft inquiries (don't hurt your score):

- Checking your own credit

- Prequalification checks

- Employer background checks

- Insurance quotes

The Pre-Loan Inquiry Strategy

6+ months before applying for major loan:

- Stop all credit card applications

- Avoid financing anything (furniture, electronics, etc.)

- Don't apply for new credit unless absolutely necessary

Exception - Rate Shopping Window: When you're ready to apply for your loan, FICO allows a 14-45 day window where multiple inquiries for the same type of loan (all mortgage or all auto) count as a single inquiry. Use this to shop rates without tanking your score.

Step 5: Leverage Credit-Building Tools

Beyond the basics, there are specific tools that can accelerate score improvement before a loan application.

Experian Boost (Free and Instant)

What it does: Adds utility, phone, and streaming service payments to your Experian credit report.

How it helps: If you've been paying these bills on time, you can get instant positive payment history. Users see an average 13-point score increase.

When to use it: Immediately—it's free and can only help, never hurt.

Authorized User Strategy

How it works: Someone with excellent credit adds you as an authorized user on their credit card. Their account history (including age and payment history) can appear on your credit report.

Requirements for maximum benefit:

- Primary cardholder has 700+ credit score

- Card has perfect payment history

- Card has low utilization (under 10%)

- Card has been open for several years (adds to your credit age)

- Card issuer reports authorized users to all three bureaus

Potential boost: 20-50 points if the account is old and well-managed.

Risk: If the primary cardholder misses payments or maxes out the card, it can hurt your score. Choose carefully.

Secured Credit Cards (If You Have Limited Credit)

If you're building credit from scratch or recovering from major negatives, secured cards can help establish positive payment history.

Best secured cards for credit building:

- Discover it Secured: Graduates to unsecured, earns cashback, reports to all three bureaus

- Capital One Platinum Secured: Low deposit options, upgrade path to unsecured

For more on credit-building tools and rebuilding strategies, see our best credit repair services guide for when DIY isn't enough.

Timeline: When to Start Improving Your Score

How much time you need depends on your starting point and target score.

30-60 Days Before Loan Application

Focus on:

- Paying down credit card balances (especially high-utilization cards)

- Disputing any obvious errors on credit reports

- Setting up Experian Boost

- Ensuring autopay is active on all accounts

Expected improvement: 20-40 points if you had high utilization or errors

3-6 Months Before Loan Application

Focus on:

- All 30-60 day strategies above

- Building perfect payment history (6 months of on-time payments)

- Becoming authorized user on family member's card (if available)

- Stopping all new credit applications

Expected improvement: 40-80 points with comprehensive approach

6-12 Months Before Loan Application

Focus on:

- All strategies above

- Opening secured card if building from scratch

- Paying down or settling collections

- Building credit age and mix

Expected improvement: 80-150+ points with major issues addressed

If you're dealing with overwhelming debt alongside credit issues and need a comprehensive approach, check out our debt payoff guide to balance debt reduction with credit building.

What Not to Do Before Applying for a Loan

Avoiding mistakes is just as important as taking positive action.

Don't Close Old Credit Cards

Why it hurts: Reduces your available credit (increases utilization) and potentially lowers your average credit age.

Better approach: Keep cards open with small recurring charges on autopay ($5-20/month subscriptions).

Don't Max Out Cards to Pay Off Other Debt

Why it hurts: High utilization tanks your score even if you're consolidating debt.

Better approach: If consolidating, use a personal loan or balance transfer card with 0% APR promo (counts as installment loan, not revolving credit).

Don't Ignore Collections Hoping They'll Go Away

Why it hurts: Collections stay on your report for 7 years and can block loan approvals.

Better approach: Negotiate pay-for-delete or settle for less than owed, but get it removed from your report as part of the agreement.

Don't Apply for Multiple Credit Cards "Just to Build Credit"

Why it hurts: Multiple hard inquiries in short period drops your score and looks desperate to lenders.

Better approach: If you need to build credit, open ONE secured card or become an authorized user instead.

Ready to Optimize Your Credit Before Your Loan?

Start with the quick wins: pull your credit reports, dispute errors, and pay down high-utilization cards. These three steps alone can boost your score 30-50 points in 60 days.

Explore All Credit StrategiesFrequently Asked Questions

How fast can I realistically improve my credit score?

You can see 20-40 point improvements in 30-60 days by addressing utilization and errors, but meaningful recovery takes 3-6 months. The timeline depends on your starting point and what's dragging your score down. If you have high utilization (above 50%) and can pay it down, you might see a 30-50 point jump within one statement cycle (30 days). If you're building payment history after late payments, expect gradual improvement over 6-12 months as recent on-time payments outweigh past mistakes. Major recovery from collections or charge-offs typically takes 12-24 months of consistent positive behavior.

Will checking my credit score lower it?

No—checking your own credit score is a "soft inquiry" and has zero impact on your score. You should be checking your credit regularly (monthly is ideal) to catch errors, monitor progress, and watch for identity theft. What does hurt your score are "hard inquiries" from lenders when you apply for credit. Even then, the impact is minor (5-10 points) and temporary (drops off after 2 years, stops affecting score after 1 year). Use free tools like Credit Karma, Experian's app, or your bank's credit monitoring to check as often as you want without worry.

Should I pay off collections before applying for a loan?

It depends on your timeline and the collection age, but generally yes—with strategic negotiation. Here's the nuance: paying a collection doesn't remove it from your report (it just changes from "unpaid" to "paid"). Newer scoring models (FICO 9, VantageScore 3.0+) ignore paid collections, but many lenders still use FICO 8, which counts them. Best strategy: negotiate "pay-for-delete" where you pay the collection in exchange for removal from your credit report. Get this in writing before paying. If they won't agree to deletion, paying the collection still helps because most lenders require collections to be paid or settled before loan approval. For guidance on negotiating collections, see our debt settlement comparison guide.

How much will my score drop when I apply for a loan?

Typically 5-10 points per hard inquiry, but rate shopping for the same loan type within 14-45 days counts as one inquiry. This is called the "rate shopping window" and it's designed to let you compare offers without penalty. So if you apply to 5 mortgage lenders within a 30-day period, it only counts as one hard inquiry on your credit report. However, if you apply for a mortgage, then an auto loan, then a credit card all in the same month, those are three separate inquiries that each drop your score 5-10 points. The impact is temporary—hard inquiries stop affecting your score after 12 months and disappear from your report after 24 months.

Is it better to have a small balance or zero balance on credit cards?

Small balance (1-5% utilization) is ideal for credit scoring—it shows you're actively using credit responsibly. Having 0% utilization across all cards can actually hurt your score slightly because it suggests you're not using credit at all. However, this only matters if you're trying to max out your score (750+). For most people preparing for a loan, keeping utilization under 10% is the sweet spot. Practical approach: use your cards for normal purchases and pay the statement balance in full every month. This keeps utilization low while showing active, responsible credit use. Never carry a balance and pay interest just to "build credit"—that's a myth that costs you money.

Can becoming an authorized user really boost my score?

Yes, if the primary cardholder has excellent credit—you can see a 20-50 point increase almost immediately. When you're added as an authorized user, the account's entire history can appear on your credit report, including its age and payment history. This is most powerful if: (1) the card has been open for many years (adds to your credit age), (2) the primary cardholder has perfect payment history, and (3) the card has low utilization. The boost happens fast—usually within 1-2 statement cycles after you're added. Critical caveat: if the primary cardholder misses payments or maxes out the card, that negative activity also affects your score. Only do this with someone you completely trust who has excellent credit habits.

What credit score do I need to get approved for a mortgage?

Conventional loans typically require 620+ for approval, but 740+ gets you the best rates—the difference can save you over $100,000 in interest. Here's the breakdown: FHA loans (backed by government) accept scores as low as 580 with 3.5% down, or 500-579 with 10% down. Conventional loans usually require 620 minimum, but you'll get mediocre rates. The best conventional loan rates kick in at 740+. For context: on a $300,000 mortgage, the difference between a 620 score (7.5% rate) and 740 score (6.0% rate) is about $300/month and $107,000 over 30 years. That's why improving your score before applying is worth the effort—even a 40-50 point increase can bump you into a better rate tier.

Resources

Related PersonalOne Articles:

- Debt Relief and Credit Repair Hub – Complete overview of all credit and debt strategies

- Credit Repair Guide for Millennials – Comprehensive credit rebuilding framework

- Pay Off Debt Without Losing It – Balance debt payoff with credit building

- Debt Settlement vs Bankruptcy – Options for handling overwhelming debt

- Best Credit Repair Services 2025 – When to consider professional help

External Tools & Resources:

- AnnualCreditReport.com – Free credit reports from all three bureaus

- Experian Boost – Free tool to add positive payment history instantly

- Consumer.gov – Making a Budget – Government budgeting resource

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as financial advice. PersonalOne.org is not a financial advisor, credit counselor, or lending institution, and we do not provide personalized financial, credit, or legal advice.

Credit improvement strategies can affect your credit profile. Before making any decisions about credit repair, loan applications, or financial products, we strongly recommend consulting with a qualified financial advisor or credit counselor who can evaluate your specific situation.

Individual results may vary based on your unique credit profile, payment history, debt amounts, and other factors. The timelines, score improvements, and interest rate examples mentioned in this article are for illustration purposes only and do not guarantee specific outcomes.

PersonalOne.org may earn affiliate commissions from some of the products or services mentioned in this article. However, our editorial content is independent and objective, and we only recommend products or services we believe may benefit our readers. For more information, please see our Privacy Policy and Terms of Service.